Goods and Service Tax (GST)

Goods and Services Tax (GST) is the new age of indirect taxation of India which has subsumed majority of indirect taxes that were prevalent in previous era viz. Excise Duty, Sales Tax, Service Tax, etc. With every change, comes an opportunity to explore and excel new horizons. We at SM and Associates take immense pride of being catalyst in implementation of GST in business processes of our clients and guiding them through every aspect of this new legislation.

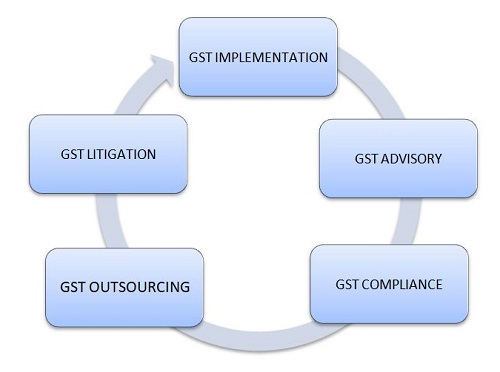

Our team of experts having decades of experience in core area of indirect taxation provides distinct services under GST regulations right from implementation to litigation. We believe that service is a continuous process of serving the need in an efficient and effective manner. The following diagram explains broad categories of services which we offer in the realm of GST:

GST Implementation Services:

- We help business organisations to establish robust automated accounting system is in sync with GST laws & regulations.

- We assist in formulating trade policies and procedures of business so as to make optimum utilisation of available Cenvat credit and other schemes under GST.

- Preparing submissions before tax, appellate authorities and writ courts

- We support in overall implementation of GST in the business process of client

GST Advisory Services:

- We guide our clients in identifying potential risk area and related opportunities under GST regime

- We conduct regular corporate health checkups in order to find deficiencies in system and advise best possible course of action.

GST Compliance Services:

- We facilitate computation of State-wise GST liability of the entity according to GST Laws, Notification and Guidelines.

- We follow strict time schedules for filing on time periodic GST returns on Pan India basis. It gives our client a single centralised filing place which can be accessed by them at their convenience.

- We assist in reconciling liabilities of return with the books; in case of deviation, we advise how it can be streamlined in future.

- We continuously share knowledge with our clients with respect to statutory updates on GST through Notifications, Amendments, etc.

GST Litigation Services:

- We have a team of qualified professional assisting clients in appeals, revision, refund and other related matters.

- We have a very successful record of representing our clients at various judicial platforms viz. Commissioner (Appeals), Tribunal, High Court, Supreme Court.

- We facilitate interpretation and advisory on GST Laws in the matters pending before judicial authorities.

GST Outsourcing Services:

- We help clients to outsource whole GST compliance process to us which enables them to focus on their business.